Are you 55 & quietly saying

RETIRE BY CHOICE

Not because of age or any other compulsion - because you feel financially settled.

Simple conversation. No pressure.

Retirement Today Is Different

In our country, retirement is no longer just about stopping work. Most working professionals, senior employees, and business owners are nowadays thinking:

- Will my money last?

- Can I manage monthly expenses comfortably?

- What about medical and family responsibilities?

- Can I do work as per my wishes and without financial pressure?

These are not greedy questions. These are practical, real-life concerns, today. And they deserve proper planning, not any guesswork.

Are You feeling this?

If this sounds like you – you’re not late. You’re just a step away to find clarity and safety.

One Clear System for a Comfortable Life

Most retirement tension comes from one problem: Money exists, but it is scattered. Real comfort comes when:

- Savings are aligned to time-based goals

- Income needs are clear and justifiable

- Income needs are clear and justifiable

- Decisions feel calm and profitable

Not from shortcuts. Not from chasing returns. But from a clear Smart Retirement Approach by MyWealthCreator.

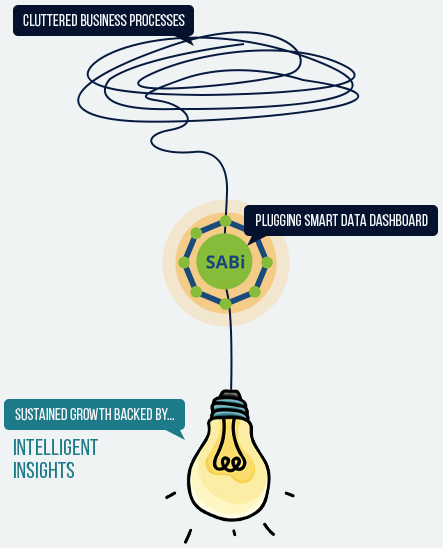

The answer lies in one simple understanding

Not tips, Not product advice But a structured retirement system designed specifically for senior citizens - one that focuses on stability, suitability, and calm decision-making.

This approach focuses on:

MyWealthCreator SMART RETIREMENT APPROACH

-

Monthly cash-flow planning

So expenses are covered without stress

-

Disciplined SIP & long-term investments

Built for safety and suitability, not excitement

-

Post-retirement income planning

So some money keeps coming regularly

-

Periodic reviews

To adjust as life changes

-

Tax-aware decisions

So unnecessary leakage is avoided Less noise. More confidence. Better sleep.

BEHIND THIS SMART APPROACH

-

Why retirees trust Somya Jowardar

-

Founder & CEO - MyWealthCreator

With 18+ years in Indian financial services, Somya has worked with:

-

Salaried professionals

-

Senior executives

-

Business owners

-

Retiring and retired individuals

He Believes: People don’t need predictions. They need comfort with their financial decisions. He helps people feel settled, not restless.

This Is Right for You If You Want

A tension-free retirement life

A tension-free retirement life

A tension-free retirement life

Fewer decisions, made properly

Guidance that feels honest and calm

This is ideal for Indian working professionals and retireeswho value peace over profits

What retirees say

Earlier, everything felt scattered. Now there’s clarity.

START WITH CLARITY, The Financial Clarity Call

This is a simple, educational conversation to help you understand:

Whether your current savings are enough or need some changes!

Whether your money can support your post-retirement life!

Where small improvements can reduce future tension!

Zero selling. Zero pressure.100% understanding.

Remember Investments are subject to market risks. This discussion is for educational and suitability purposes only.

FAQ's

Indian professionals and retirees who want long-term comfort and financial safety.

Check if this suits you

No.

The focus is not age – it’s how much ready you are.

Explore at your stage

No.

The idea is to reduce daily thinking about money, not increase it.

See how it works

No.

Everything is explained in simple, everyday language.

Start without confusion

That’s normal.

The structure is reviewed and adjusted when required.

Build flexibility safely

Understand whether your current savings can support the life you want- peacefully